CAIS Sports, Media and Entertainment Fund

The CAIS Sports, Media and Entertainment Fund (the "Fund") is a new registered evergreen fund1 offering accredited investors access to a portfolio targeting long-term exposure to investments in the sports, media and/or entertainment industries, which may include all five major North American sports leagues (professional American football, NBA, MLB, NHL, and MLS), in a single portfolio.

Subscription

Quarterly

Investment Minimum2

$25,000

Tax Reporting

1099

Anticipated Liquidity3

Semi-annual

Fund repurchases are subject to board approval, tender offer limits, and early withdrawal charges.

1The Fund is continuously offered closed-end management investment company and is registered under the Investment company Act of 1940.

2Minimum investment amount shown is for Class D Shares. Minimum investment amounts for other share classes may differ. The minimum subsequent investment for each share class is $10,000.

3Liquidity for the Fund’s Shares will be provided only through tender offers. The Adviser intends to recommend to the Board of Trustees (the “Board”), subject to the Board’s discretion, that the Fund offer to repurchase Shares from shareholders on a semi-annual basis in an amount generally not to exceed 5% of the Fund’s net asset value. There is no guarantee that an investor will be able to sell all the Shares that the investor desires to sell in the tender offer or that such tender offers will occur as scheduled, or at all. Accordingly, an investor should consider an investment in the Fund to be a long-term investment that is inherently illiquid and suitable only for investors who can bear the risks associated with the Fund's limited liquidity. Please see the Fund’s prospectus for more details.

Investing Across the Sports, Media, and Entertainment ("SME") Universe

94%

of the most watched, non-election shows in 2024

were sports games.4

1,400+

hours worth of content was streamed by the

average American in 2024.5

All 5

of the major North American leagues (NFL, MLB, NBA, NHL, MLS) now allow institutional ownership.6

Uncorrelated

to private equity, private debt, public equity,

and public debt.7

4Total % of Sports programming, exempt of election related programming, of the top 100 shows in 2024. CAIS Advisors, Crupi, Anthony, “NFL Owns 72 of TV’s Top 100,” 2025.

5Felton, Kennedy, Americans Cut Back On Streaming Services in 2024, 2024.

6Subject to certain restrictions

7Bloomberg, Preqin. Correlations between RASFI and other market indices range from -0.2 to +0.1 and are computed using quarterly returns from Q1 2008 - Q1 2025. Public Equity is represented by the S&P 500 Total Return Index, which tracks 500 large U.S. companies, and is commonly used to represent U.S. public equity performance. Public Debt is represented by the Bloomberg Barclays US Aggregate Bond Index TR, which represents the U.S. investment-grade bond market, including government, corporate, and mortgage-backed securities. Private Equity is represented by Preqin Private Equity Index, which measures global private equity fund performance across strategies like buyout and venture capital. Private Debt is represented by Preqin Private Debt Index, which tracks private debt fund performance, including direct lending and mezzanine strategies. Sports Franchises is represented by the Ross-Arctos Sports Franchise Index (“RASFI”). The RASFI seeks to estimate the aggregate value and performance of North American sports franchises that comprise NFL, NBA, MLB, and NHL. For more details, see Michigan Ross, Michigan Ross School of Business and Arctos Launch Pioneering Sports Franchise Index, September 2024.

Fund Facts

|

Investment Objective |

Seek long-term capital appreciation |

|

Structure |

1940 Act Registered Tender Offer Fund |

|

Investor Eligibility |

Accredited Investor (U.S. taxable & U.S. tax-exempt investors eligible) |

|

Investment Minimum |

$25,000 minimum investment, $10,000 subsequent investment minimum8 |

|

Term |

Perpetual |

|

Tax Reporting |

Form 1099 |

|

Subscription |

Quarterly |

|

Liquidity |

Anticipated semi-annual limited liquidity via tender offers, subject to board approval, tender offer limits and early withdrawal charges9 |

|

Distributions |

Annual10 |

|

Management Fee |

0.95% of net asset value |

|

Adviser's Incentive Fees |

None11 |

8Minimum investment of $25,000 is for Class D Shares. The minimum subsequent investment for each share class is $10,000.

9 Liquidity for the Fund’s Shares will be provided only through tender offers. The Adviser intends to recommend to the Board of Trustees (the “Board”), subject to the Board’s discretion, that the Fund offer to repurchase Shares from shareholders on a semi-annual basis in an amount generally not to exceed 5% of the Fund’s net asset value. There is no guarantee that an investor will be able to sell all the Shares that the investor desires to sell in the tender offer or that such tender offers will occur as scheduled, or at all. Due to these restrictions, an investor should consider an investment in the Fund to be a long-term investment that is inherently illiquid and suitable only for investors who can bear the risks associated with the Fund's limited liquidity. Please see the Fund’s prospectus for more details.

10The amount of distributions that the Fund may pay, if any, is uncertain.

11The portfolio funds in which the Fund intends to invest generally charge between 0% and 20% of net profits as a carried interest allocation

-

Pursues private market opportunities–such as commitments to new funds, secondary purchases of existing fund interests, and co-investments alongside select managers–alongside publicly traded securities as part of its SME investment strategy

-

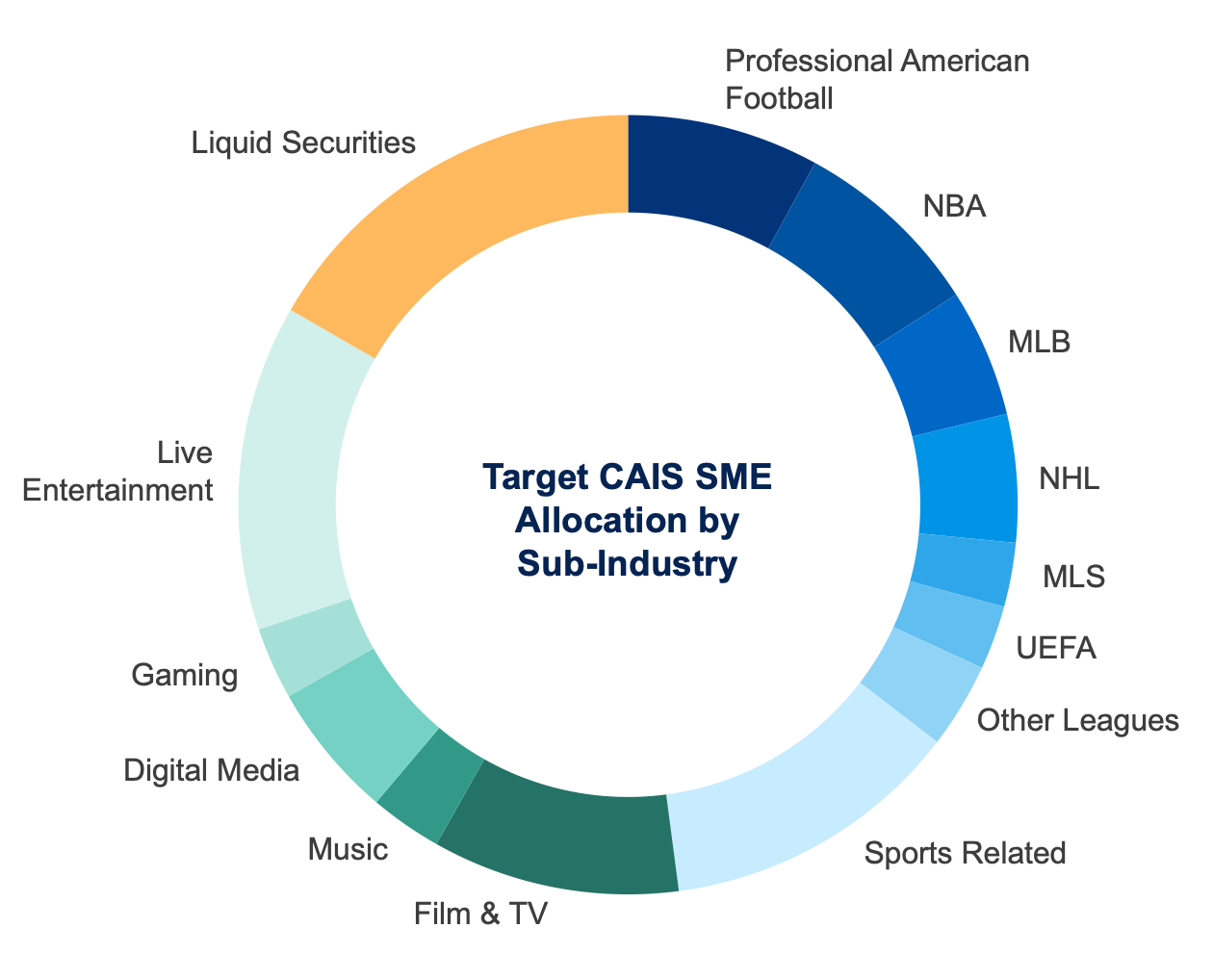

Targets a portfolio of diverse SME exposures across sports, film & TV, music, gaming, digital media, and live events12

Illustrative graphic shown above reflects targeted potential portfolio positioning for the Fund. Actual allocations may materially deviate from the above for numerous reasons, including, without limitation, due to the availability of secondary, co-investment, and primary opportunities. Sub-industries shown are representative of the industry classification from the Fund's prospectus.

12The Fund is classified as "non-diversified" for purposes of the Investment Company Act of 1940 and is not intended as a complete investment program.

Companies, businesses and investments in the "sports" industry include, but are not limited to, sports franchises, sports leagues, sports content creation and/or distribution platforms, sports-related media rights, sports merchandise or equipment, sports-related gaming or betting platforms (including fantasy sports and prediction markets), sporting tournaments and major events, sports-related facilities and/or adjacent real estate ownership or operations, sports and health technology, sports data and analytics platforms, eSports organizations, college athletics, name-, image-, and likeness-related businesses, youth or amateur sports platforms, athlete-driven media ventures, athlete representation or sponsorship monetization platforms, and firms supporting the sports ecosystem through marketing, sponsorship, consulting, advisory, and/or technology services.

Companies, businesses and investments in the "media and entertainment" industry include, but are not limited to, movie and/or television studios, streaming platforms, video or mobile game developers or publishing, music platforms (including labels, rights holders, and/or production companies), digital media, social media, publishing platforms, celebrity- or influencer-led media ventures, entertainment intellectual property and content libraries, talent representation or management, ticketing and fan engagement platforms, live entertainment and/or event businesses, leisure facilities or experience-based venues, casinos and/or gaming, advertising and brand marketing platforms, and broadcast, cable, and satellite networks or distribution platforms.

Neil Blundell

Chief Investment Officer and

Portfolio Manager

CAIS Advisors

Sarah Jiang

Managing Director and

Portfolio Manager

CAIS Advisors

Investing in Vehicles Managed by Experienced Managers

The Fund plans to initially allocate a significant percentage of its assets to investment vehicles managed by Arctos and Eldridge.13

The only private investment firm approved to own equity across all 5 major North American leagues.14

Sports and entertainment investor with a portfolio of assets across sports, film & TV, music, live entertainment, and more.

13“Arctos” refers to Arctos Partners, LP or its affiliates and “Eldridge” refers to Eldridge Capital Management, LLC or its affiliates, collectively the Core Independent Managers.

14As of September 30, 2025. Source: Business Wire, “Arctos Announces the Launch of Dedicated Sports Capital Markets Platform.”

About CAIS Advisors

CAIS Advisors is an SEC-registered investment adviser that manages, or is anticipated to manage, a suite of private and registered alternative investment funds spanning various objectives and asset classes. CAIS Advisors also provides non-discretionary advisory services to institutional asset managers in developing alternative investment model portfolios. To learn more, visit: https://adviserinfo.sec.gov/firm/summary/317466.

Form ADV

Investors should carefully consider the investment objectives, risks, and charges and expenses of the Fund before investing. The prospectus contains this and other information about the Fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 844-241-8667. The fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC, which is not affiliated with CAIS Advisors.

This communication is a marketing communication and is for informational purposes only. Offering by prospectus only. Investment in the CAIS Sports, Media and Entertainment Fund (the “Fund”) will carry a high degree of risk. This communication does not constitute an offer or solicitation of an offer to buy, sell, or hold securities, financial instruments or products or constitute a solicitation on behalf of any issuer and is not intended and should be construed as a recommendation or investment advice to buy or sell the Fund’s shares. An investment in the Fund requires the financial ability and willingness to accept high risks and lack of liquidity associated with an investment. Investors must be prepared to bear such risks for an indefinite period of time. Investors should not construe the performance of any similarly situated funds or investment vehicles as providing any assurance or predictive value regarding the future performance of a fund for which CAIS Advisors provides advisory services. Past performance is no guarantee of future results.

The material contained herein may not be reproduced, shown or otherwise communicated or quoted to members of the public, nor used in written form as sales material. The material presented herein is subject to change and should not be construed as impartial investment research or analysis.

CAIS Advisors is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about CAIS Advisors, including its investment strategies, fees, and objectives, are fully described in the Firm’s Form ADV Part 2, which is available by calling (212) 300-9355, or by visiting the Investment Adviser Public Disclosure website, available at https://adviserinfo.sec.gov/.

CAIS Advisors is a wholly owned subsidiary of CAIS. There are financial institutions that own interests in CAIS, the parent company of CAIS Advisors. These financial institutions may also be general partners, Investment Advisors, sponsors, issuers, or an equivalent, or an affiliated entity, to certain strategies, underlying funds, or investment vehicles into which CAIS Advisors will invest, thus raising potential conflicts of interest. For example, CAIS Advisors may be more willing, or incentivized, to allocate to investments controlled by a shareholder of CAIS, rather than a sponsor of another financial product to which there is no ownership interest in, CAIS.

Because the Fund intends to allocate a significant percentage of its assets to investment vehicles managed by the Core Independent Managers, as defined in the prospectus, conflicts of interest may arise as a consequence of investment management and other financial advisory services in which the Adviser, the Core Independent Managers and their affiliates are engaged. Each of the Core Independent Managers provides investment advisory services to investment vehicles.

An entity affiliated with Eldridge, one of the Core Independent Managers, owns a minority non-controlling share in CAIS and holds two out of nine seats on the board of directors of CAIS. Although Eldridge holds an indirect minority ownership stake in CAIS, this does not result in Eldridge assuming any fiduciary duties toward CAIS, the Adviser or its clients. Eldridge’s ownership interest in CAIS creates a conflict of interest in connection with the Fund’s investment strategy to invest in Eldridge-sponsored funds, in respect of which the Fund will pay the management fees and/or other incentive compensation to Eldridge.

From time to time, CAIS may enter into operational services agreements with Eldridge to provide operational services to various investment vehicles sponsored by Eldridge unrelated to the Fund. In addition, CAIS or its affiliates may have other business relationships and/or other financial shares unrelated to the Fund with the Core Independent Managers or their shares that may present conflicts of interest.

An investment in the Fund could result in a partial or complete loss of principal investment.

Unless otherwise indicated, the date of creation for this page is November 20, 2025, and all information herein speaks of such a date. The Fund is a closed-end investment company with no history of operations. It is not intended that the Fund’s Shares will be listed on a public exchange at this time. No secondary market is expected to develop for the Fund’s Shares. CAIS Advisors and its respective affiliates, members, partners, shareholders, managers, directors, officers, employees, and agents, do not undertake any obligation to update or amend any of the information herein. Past performance is no guarantee of future results, and is not indicative of expected realized returns. All investments are subject to risk, including the loss of principal amount invested. These risks may include limited operating history, uncertain distributions, inconsistent valuation of the portfolio, changing interest rates, leveraging of assets, reliance on the investment advisor, potential conflicts of interest, payment of substantial fees to the investment adviser, illiquidity, and liquidation at more or less than the original amount invested. Diversification will not guarantee profitability or protection against loss. Performance may be volatile, and the NAV may fluctuate.

Please be advised that any reference to a targeted or projected return, value, date, or metric contained in this presentation is merely an estimated “target” and, therefore is inherently subject to a variety of risks and uncertainties that could cause actual results to differ materially from those targeted. Target returns, to the extent applicable and presented herein, are based on CAIS Advisors belief about returns that may be achievable on investments that CAIS Advisors intends to pursue considering historical performance, the view on current market conditions, and certain assumptions about investing conditions, hold periods, availability of financing, and exit opportunities. While targeted performance is based on assumptions that CAIS Advisors believes are reasonable, it is important to highlight that there are many risk factors that could cause CAIS Advisors’ assumptions to prove to be incorrect. Accordingly, these risks could cause actual performance to be materially different from the current targeted or projected performance. Such risks may include, but are not limited to: (1) availability of suitable investments, and financing; (2) interest rates; (3) economic and market conditions. Targeted returns are not projections, predictions, or guarantees of future performance, and none of CAIS Advisors, or any of its respective, directors, officers, employees, partners, shareholders, advisers, and agents make any assurances, representations, or warranty as to the accuracy or achievability of any targeted returns and no recipient of this document should rely on such targets. Additional details regarding methodologies and assumptions used to calculate targeted returns are available upon request. Unless otherwise indicated, projections are presented on net basis and reflect the deduction of fees and expenses, including as applicable, management fee or incentive allocations, taxes, transaction costs related to the disposition of unrealized investments or the fund or company-level taxes, or other fund or company-level expenses that are expected to be borne by the relevant vehicle’s investors, which will reduce returns and are expected to be substantial in the aggregate. Net performance information for projections cannot be calculated without making arbitrary assumptions about timing of fees and expenses.

Statements contained in this presentation are based on current (unless otherwise noted) expectations, estimates, projections, opinions and beliefs of CAIS Advisors on the date this presentation was created. Such statements involve known and unknown risks and uncertainties, and undue reliance should not be placed thereon. In addition, some of the items discussed in this presentation include forward looking statements. CAIS Advisors has tried to identify forward looking statements by use of terminology such as “may”, “will”, “should”, “could”, “would”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similarly situated expressions. Please be advised that forward looking statements are subject to a number of risks and uncertainties, some of which are beyond the control of CAIS Advisors and its affiliated entities, including among other things, the risks listed in the Funds prospectus. Actual results, performance and opportunities could differ materially from those expressed in or implied by the forward looking statements. Undue reliance should not be placed on forward looking statements. CAIS Advisors and its affiliated entities undertake no obligation to update or revise any forward looking statements, whether as a result of new information, future events, or otherwise.

INDEX DEFINITIONS

The S&P 500 Total Return Index tracks 500 large U.S. companies, and is commonly used to represent U.S. public equity performance. The Bloomberg Barclays US Aggregate Bond Index TR represents the U.S. investment-grade bond market, including government, corporate, and mortgage-backed securities. The Preqin Private Equity Index measures global private equity fund performance across strategies like buyout and venture capital. The Preqin Private Debt Index tracks private debt fund performance, including direct lending and mezzanine strategies. The Ross-Arctos Sports Franchise Index (“RASFI”) seeks to estimate the aggregate value and performance of North American sports franchises that comprise NFL, NBA, MLB, and NHL. For more details, see Michigan Ross, Michigan Ross School of Business and Arctos Launch Pioneering Sports Franchise Index, September 2024.

SUMMARY OF CERTAIN RISK FACTORS

Investing in the Fund involves risks, including the risk that investors may receive little or no return on their investment or that they may lose part or all of their investment. An investment in the Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Shares and should be viewed as a long-term investment. An investment in the Fund should not be viewed as a complete investment program. Before investing, prospective investors should consider carefully the following risks and review more detailed information set forth in the Fund’s Prospectus under the heading “Principal Risk Factors.” Capitalized terms used but not otherwise defined in this section have the meanings ascribed to them in the Fund’s Prospectus.

-

Investing in the Fund can result in a loss of capital, up to the entire amount of an investor’s investment.

-

The Fund is a closed-end investment company with no history of operations. It is not intended that the Fund’s Shares will be listed on a public exchange at this time. No secondary market exists or is expected to develop for the Fund’s Shares. Certain Portfolio Funds may have limited operating histories.

-

The Fund’s Shares are subject to substantial restrictions on transfer and are extremely illiquid.

-

The Fund’s strategy includes direct or indirect investments in sports, media and/or entertainment opportunities — industries that are highly competitive and subject to unpredictable consumer interests. The success of companies in these sectors depends on numerous factors. Each creative work — whether films, TV shows, sports broadcasts, or live events — represents an individual project whose commercial success is inherently uncertain and primarily determined by consumer appeal and market reception. See “Risks Related to SME Investments – Uncertain Consumer Demand.”

-

The Fund is a non-diversified fund, which means that the percentage of its assets that may be invested in the securities of a single issuer is not limited by the 1940 Act. As a result, the Fund’s investment portfolio may be subject to greater risk and volatility than a diversified fund.

-

The Fund will be concentrated (i.e., more than 25% of the value of the Fund’s assets will be invested) in one or more industries within the SME group of industries and, as such, it may be subject to more risks associated with those industries than if it were more broadly diversified over numerous industries.

-

Portfolio Funds generally will not be registered as investment companies under the 1940 Act and, consequently, a Portfolio Fund will not have the protections of the 1940 Act.

-

The Fund invests in Portfolio Funds. Portfolio Funds are subject to certain risks, including risks related to illiquidity, indirect fees, valuation, limited operating histories, and limited information regarding underlying investments. In connection with the Fund’s investments in Portfolio Funds, the Fund may hold a significant portion of its assets in cash and cash equivalents in support of unfunded commitments.

-

The use of leverage by the Fund or a Portfolio Fund may increase the volatility of the Fund and such Portfolio Fund and can result in significant losses. The use of leverage may increase the fees payable to the Fund by increasing the asset base on which the Management Fee is calculated. This creates a potential incentive for the Adviser to use leverage and to select Portfolio Funds that use leverage.

-

Portfolio Funds may pursue investment strategies or make individual investments that have not been fully disclosed to the Adviser and are different from those expected to be made at the time the Fund made its decision to invest in the Portfolio Funds. Such strategies and investments may be inconsistent with the investment objective and policies of the Fund and may involve unanticipated risks, which could adversely affect the Fund.

-

The Adviser may have limited access to the specific underlying holdings of the Portfolio Funds and little or no means of independently verifying information provided by the Underlying Managers.

-

In calculating the Fund’s NAV, the Fund will utilize valuations of the Fund’s interests in Portfolio Funds, without any means of independent verification. Underlying Managers face a conflict of interest in valuing securities held by Portfolio Funds because the values assigned will affect the compensation paid to such Underlying Managers.

-

The Fund may make additional investments in or effect withdrawals from Portfolio Funds only at certain times. Limitations on a Fund’s ability to withdraw its assets from Portfolio Funds will limit the Fund’s ability to repurchase its Shares and therefore the investor’s ability to redeem its Shares in the Fund.

-

The Fund may receive securities that are illiquid or difficult to value in connection with withdrawals and distributions from Portfolio Funds.

-

The Underlying Managers will charge the Fund asset-based fees and typically will also be entitled to receive performance-based allocations. These are in addition to the Management Fee borne by investors in the Fund. These asset-based and incentive fees are paid directly by the Portfolio Funds to the Underlying Managers and are indirectly borne by investors in the Fund.

-

Performance-based fees/allocations may create incentives for Underlying Managers to make risky and speculative investments.

-

The Fund may be subject to performance-based allocations by Underlying Managers even if the Fund’s overall returns are negative.

-

The Adviser and Underlying Managers may have conflicts of interest that could interfere with their management of the Fund or the Portfolio Funds, respectively. For example, the Adviser and its affiliates, as well as many of the Underlying Managers and their respective affiliates, provide investment advisory and/or other services to clients other than the Fund and Portfolio Funds, and the side-by-side management of these clients may raise potential conflicts of interest relating to the allocation of investment opportunities. See “Principal Conflicts of Interest.”

-

Delays in Underlying Manager reporting may delay reports to shareholders and require shareholders to seek extensions of the deadline to file their tax returns.

-

The Fund is subject to, and invests in Portfolio Funds that are subject to, risks associated with legal and regulatory changes applicable to financial institutions generally or Portfolio Funds in particular.

-

The Fund and Portfolio Funds may invest in fixed income securities, rated investment grade or non-investment grade and may invest in unrated fixed income securities. Non-investment grade debt securities are commonly referred to as “junk” or “high yield” securities, and are considered speculative with respect to the issuer’s capacity to pay interest and repay principal. Non-investment grade securities in the lowest rating categories or unrated debt securities determined to be of comparable quality may involve a substantial risk of default or may be in default. See “Risks Related to the Fund’s Investments – High Yield and Unrated Securities Risk.”

-

Fund shareholders will have no right to receive information about the Portfolio Funds or the Underlying Managers, and will have no recourse against Portfolio Funds or the Underlying Managers.

-

An Underlying Manager may focus on a particular country or geographic region or on a limited number of securities or operating companies, which may subject the Portfolio Fund, and thus the Fund, to greater risk and volatility than if the focus was on a broader range of countries, geographic regions, securities or operating companies.

-

The Fund is subject to the 1940 Act prohibitions and restrictions relating to transactions between investment companies and their affiliates (including the Adviser), principal underwriters and affiliates of those affiliates or underwriters. Under these restrictions, the Fund is generally prohibited from knowingly participating in a joint transaction with an affiliated person. These restrictions also generally prohibit the Fund’s affiliates, principal underwriters and affiliates of those affiliates or underwriters from knowingly purchasing from or selling to the Fund certain securities or other properties and from lending to and borrowing from the Fund monies or other properties. The Fund and its affiliates may be precluded from co-investing in private placements of securities. The Fund and its affiliates may from time to time engage in certain joint transactions, purchases, sales and loans in reliance upon and in compliance with the conditions of certain positions promulgated by the SEC and its staff. There can be no assurance that the Fund would be able to satisfy these conditions with respect to any particular transaction. As a result of these prohibitions, restrictions may be imposed on the size of positions or the type of investments that the Fund could make.

-

The Fund faces significant risks related to global pandemics, which can severely impact the SME group of industries. While the Fund strives to mitigate these risks through strategic diversification and flexible investment approaches, the inherent uncertainty and potential for significant operational disruptions due to global pandemics remain a material risk factor for the Fund. See “Risks Related to SME Investments – Risk of Future Global Pandemics.”

-

Changes to tax laws may negatively impact the valuation and profitability of sports franchise investments. Current tax benefits, such as goodwill amortization, deductions for player salaries and stadium expenses, and pass-through tax structures, enhance cash flow and valuations. However, legislative or regulatory changes — such as limiting goodwill amortization, restricting deductions, or increasing capital gains taxes — could reduce profitability, lower franchise valuations, and extend investment holding periods. Any such changes could materially impact the Fund’s returns and investment strategy, and the Fund cannot predict the likelihood or timing of future tax law revisions.