Solactive CAIS Private Credit BDC Index

Solactive CAIS Private Credit BDC Index, CAISCRED, is a first-of-its-kind index that aims to track performance of perpetual non-traded Business Development Companies (BDCs) with a modified asset-weighted methodology.

For additional index details, please visit Solactive.

A New Standard for Private Credit Measurement

Rules-based benchmark

An accessible benchmarking tool that helps allocators track performance more effectively and better understand constituent performance relative to universe

Captures key drivers of private credit fund performance

Incorporates fund fee structure and portfolio leverage to capture private credit performance drivers

Ensuring accurate rules-based index calculation

Calculated independently and built with comprehensive data sources

At a Glance

As of 6/30/2025

42

Number of Constituents

$141B

Total Net Assets

9,000+

Unique loans held by index constituents

Data is as of 6/30/2025. Constituents data source: CAIS Advisors, aggregation of Information reported by each index constituent to the SEC.

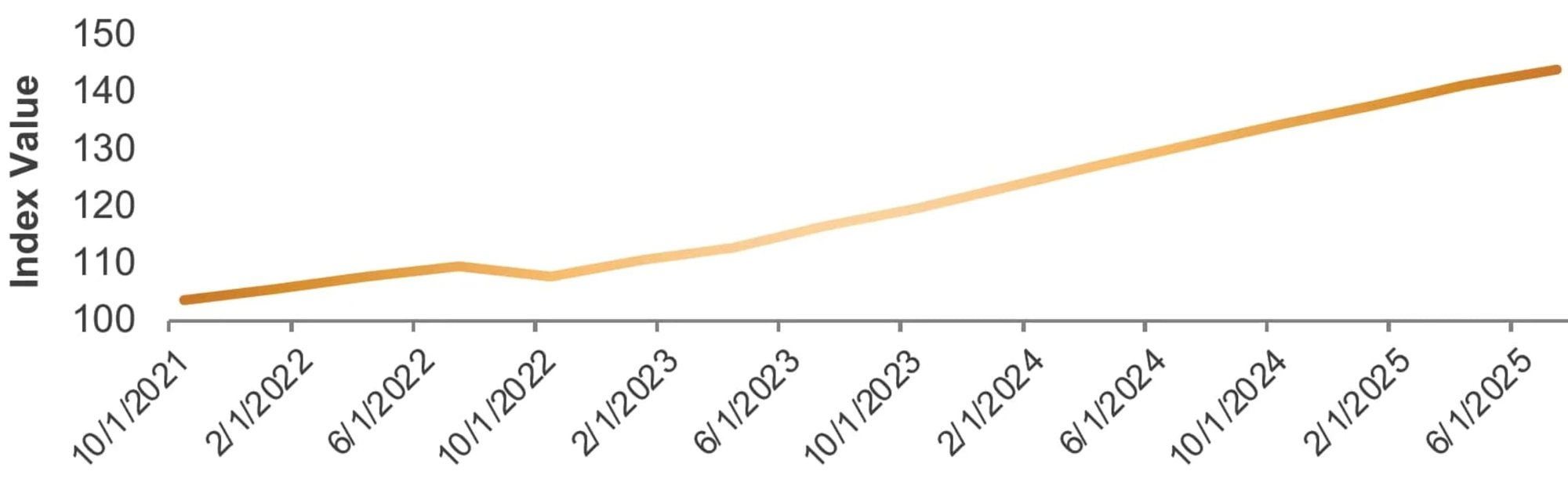

CAISCRED Performance (Base = 100 on 7/8/2021)

Source: CAIS, Solactive. Click here for additional information on the index’s methodology.

Top Five Constituents

-

Blackstone Private Credit Fund: 10.00%

-

Blue Owl Credit Income Corp.: 7.30%

-

Apollo Debt Solutions BDC: 6.33%

-

HPS Corporate Lending Fund: 5.71%

-

Ares Strategic Income Fund: 5.07%

Trailing Performance

|

Last Quarter |

2.17% |

|

Return (LTM) |

9.44% |

|

Return (3Y) |

10.98% |

|

Annualized Return |

9.93% |

Solactive AG (“Solactive”) is the licensor of Solactive CAIS Private Credit BDC Index (the “Index”). The financial instruments that are based on the Index are not sponsored, endorsed, promoted or sold by Solactive in any way and Solactive makes no express or implied representation, guarantee or assurance with regard to: (a) the advisability in investing in the financial instruments; (b) the quality, accuracy and/or completeness of the Index; and/or (c) the results obtained or to be obtained by any person or entity from the use of the Index. Solactive reserves the right to change the methods of calculation or publication with respect to the Index. Solactive shall not be liable for any damages suffered or incurred as a result of the use (or inability to use) of the Index

How CAISCRED Works

Methodology Overview

-

CAISCRED aims to track the performance of non-traded private credit funds (BDCs)

-

Modified asset-weighted methodology and rebalanced quarterly

-

Index inception date: July 8, 2021, covering Q2 2021 reporting period

Index Construction

-

Independently calculated: Developed a robust methodology in partnership with Solactive to ensure accurate rules-based index calculation

-

Building comprehensive data sources: Integrated disparate data sources to build an innovative, proprietary, and scalable database across investment strategies, structures, and regulatory regimes

Eligibility

Includes perpetual non-traded BDCs that satisfy the following requirements:

-

BDCs that function as private credit vehicles

-

Exclusive of public exchange traded and finite-life BDCs

-

Total net assets ≥ $200M

Solactive and CAIS Advisors Partnership

CAIS Advisors LLC (“CAIS Advisors”) is an SEC- registered investment adviser that manages, or is anticipated to manage, a suite of private and registered alternative investment funds spanning various objectives and asset classes, including private equity, private credit, and real estate. CAIS Advisors also provides non-discretionary advisory services to institutional asset managers in developing alternative investment model portfolios.

Solactive is a leading provider of indexing, benchmarking, and calculation solutions for the global investment and trading community. With over 30,000 indices calculated daily, Solactive offers a full suite of standard and custom index solutions, spanning all major asset classes pairing relentless innovation with a clear customer focus.

As of January 2024, Solactive served approximately 500 clients across the world, with approximately US$300 billion invested in products linked to their indices. Solactive is registered with ESMA as a benchmark administrator and is supervised by the BaFin.

This communication is for discussion and informational purposes only. Information contained herein is intended for financial professional use only. This material may not be reproduced, redistributed, quoted, or referred to, in whole or in part, without the prior written consent of CAIS Advisors LLC. Any such unauthorized use, distribution, or disclosure to third parties is prohibited. This communication does not constitute an offer or solicitation of an offer to buy, sell, or hold securities, financial instruments, or products, or constitute a solicitation on behalf of any issuer. Any such solicitation or offer may only be made pursuant to the provision of formal offering materials. Information provided herein has been obtained from public sources believed to be reliable, but no representation or warranty, express or implied, is made that such information is accurate or complete and should be relied upon as such.

CAIS Advisors LLC (“CAIS Advisors”) is an investment adviser registered with the United States Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about CAIS Advisors, including its investment strategies, fees, and objectives are fully described in the firm’s Form ADV Part 2A, which is available by calling 212-300-9355, or by visiting the Investment Adviser Public Disclosure website: https://adviserinfo.sec.gov/firm/summary/317466.

The Solactive CAIS Private Credit BDC Index aims to track the performance of non-traded private credit funds(BDCs) with a modified market-cap weighting. Detailed information about the Solactive CAIS Private Credit BDC Index, including the factsheet and rulebook, is available at https://www.solactive.com/indices/ and searching for “Solactive CAIS Private Credit BDC Index”. References to indices, benchmarks, or other measures of relative market performance are provided for informational purposes only. Indices are unmanaged, do not incur management fees, costs, or expenses, and cannot be directly invested in. The performance of an index does not represent the performance of any specific investment, and the composition of an index may not reflect the manner in which a client’s portfolio is constructed.

It is not possible to invest directly in an index. Exposure to assets represented by an index is available through investable financial instruments that seek to provide an investment return based on the performance of an index. A decision to invest in any such financial instrument should not be made in reliance on any of the statements set forth in this document. Prospective investors are advised to make an investment in any such financial instrument only after carefully considering the risks associated with investing in such financial instruments, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the financial instrument or vehicle.

Performance information shown may include backtested or hypothetical results, which are provided for illustrative purposes only. Backtested performance is calculated by applying a model or strategy to historical data. These results do not represent the actual trading of any account and do not reflect the impact of material economic and market factors that might have influenced actual decision-making. Backtested performance is inherently limited; it is prepared with the benefit of hindsight, may not account for all fees, transaction costs, or market conditions, and does not guarantee future results. Actual results may differ materially from the backtested results shown. For the avoidance of doubt, backtested data should not be relied upon as an indicator of future performance.

For further information regarding the calculation of performance and a description of the Solactive CAIS Private Credit BDC Index, please contact CAIS Advisors at 212-300-9355.